[ad_1]

Insurance networking isn’t always a sure-fire way to grow your agency. You need to have the right approach. Find out simple strategies to network your business

Building strong relationships with clients is crucial to the success of every insurance agent. This is where insurance networking plays an important role.

But networking itself won’t necessarily translate to the growth of your business. Often, you will need to take the right approach to establish meaningful connections with potential customers and win them over.

In this article, Insurance Business lists the top 5 insurance networking strategies that can help grow your business. Whether you’re a new agent trying to get your feet wet or an industry veteran looking for new leads, this guide can prove handy. Scroll down and find simple and practical insurance networking ideas that can help boost your sales.

In a relationship-oriented industry such as insurance, building strong connections with clients is vital to the success of every business. Here are 5 practical insurance networking strategies to help you form strong relationships and attract more clients.

1. Boost your social media presence.

In today’s digital age, social media platforms act as a quick and convenient way to build connections. The key is learning to use these channels the right way.

With its expansive reach, Facebook has become an essential tool for insurance agents like you to connect with your target audience, promote your services, and get more leads.

Building a professional presence on Facebook can also help you build your brand, set yourself apart from industry rivals, and reach potential clients.

By sharing helpful tips and advice, you can establish yourself as a credible expert, making it easier for prospective customers to trust you.

Another Facebook feature that can benefit your insurance networking efforts – although you will need to shell out a little bit of money – is paid advertising. This enables insurance agents to reach potential customers based on a range of parameters, including interests and behaviors. Facebook also has tools that allow you to monitor the performance of these ads.

The professional networking website LinkedIn is another great option for promoting yourself as an expert in the field. You can use the channel to share helpful information and advice, which can help build your credibility.

LinkedIn also allows you to connect with other industry professionals who can help in your insurance networking endeavors.

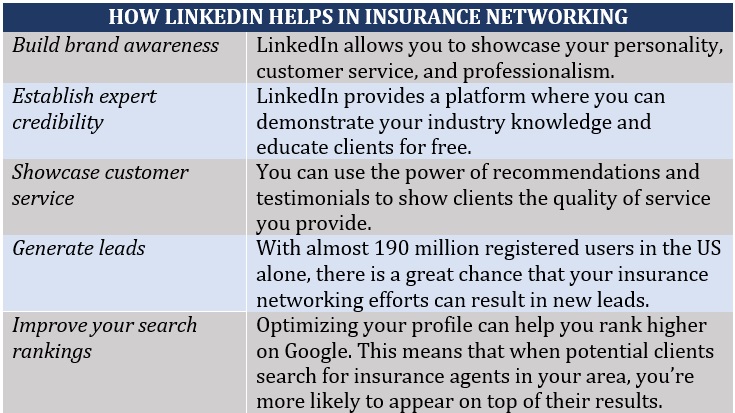

The table lists some of the benefits that LinkedIn brings to insurance agents trying to boost their network.

Other social media platforms you can use to boost your client network include X (formerly known as Twitter), YouTube, Instagram, and Google Business Profile.

With social media platforms, however, you should be careful not to come across as too salesy. Most clients are tired of sales pitches, so non-stop sales talk is counterproductive.

2. Stay active in your community.

Maintaining an active presence in your community is one of the most practical ways to boost your customer network.

Volunteering, for example, provides insurance agents with a great opportunity to meet new people and establish social connections. Apart from demonstrating your skills and expertise, giving back to your community allows you to showcase your human side and lets people know that you care.

But don’t go into these events with insurance leads on top of your mind. Remember that these events are designed to assist the needy, so it’s best to prioritize establishing rapport with others and just let insurance networking naturally flow into your conversations. Some people can easily see through your intention and having a salesperson mindset from the get-go can turn them off.

In addition, you can use your expertise to bring value to your community. Here are some of the ways insurance agents can use their industry knowledge to give back to their communities:

3. Attend insurance conferences and other events.

Industry events such as conferences provide great insurance networking opportunities with other industry professionals. Such events also allow you to connect with like-minded individuals who share your passion for making positive changes in people’s lives.

You can use insurance conferences to learn how other agents do business and keep abreast of the latest industry trends and developments. Lunch breaks, in-between sessions, and cocktail parties are often a good time to network with other agents and pick their brains.

Insurance Business holds a host of insurance conferences throughout the year. These events provide a venue for industry professionals to meet respected and dependable market leaders. You can check out the Insurance Business Events page for the complete schedule of upcoming conferences that we will be hosting.

4. Ask for referrals.

A referral from a satisfied client is one of the best ways to promote the quality of your service. Your customers, however, aren’t the only ones who can recommend your services to others. You can ask people who already trust you – including your family, friends, and former co-workers – to refer you to potential clients.

Partnering with other professionals who may share a similar clientele can also provide insurance networking opportunities. Financial planners, mortgage brokers, and real estate agents are some of the other professionals that you may want to establish a lead-sharing collaboration with.

You can send new customers to these professionals, and they can refer your business to potential clients. It’s a win-win situation. In addition, your clients may appreciate your ability to point them to another professional when the need arises.

In the unfortunate scenario that your client chooses to cancel their policy with you, it’s best not to burn bridges. Make sure to remind them that they can contact you anytime they need you.

You can also consider conducting a feedback survey where clients can suggest areas for improvement.

5. Join one of our 5-star Insurance Networks and Alliances.

The companies on our five-star Insurance Networks and Alliances list are the best options for an insurance network that can help supercharge your business. These firms are highly recommended by other insurance agents. They’ve been vetted by our panel of industry experts as respected and dependable market leaders.

By partnering with these insurance networks, you can be sure that your business is receiving quality service. This also allows your business to access a range of benefits that will enable it to thrive and grow.

Insurance networks, also referred to as agency networks or network alliances, play a key role in the insurance networking process. Insurance networks consist of independent agencies that have banded together to combine premiums. Doing so gives members the scale and benefits often accessible only to large insurance agencies.

“There was a time when agents worked together to take care of their community,” John Tiene, managing director of Strategic Agency Partners, told Insurance Business. “Sometime between the 1970s and 1990s, that got lost. But it’s back, insurance is about scale. The more scale, the more influence and opportunity exists.

“There’s a demand within the agent community for what we provide. We help them better manage their agencies. Help them utilize technology. Help with perpetuation – that’s just good business planning.”

New Jersey-based Strategic Agency Partners (SAP) is one of our five-star insurance network awardees. Part of what makes it stand out from industry rivals, according to the group, are:

- The network doesn’t impose entry fees, commission cuts, and complicated formulas to distribute profit sharing.

- Every agency remains 100% independently owned and operated.

- Agency members don’t have to take additional markets – SAP helps them align with the markets that make sense for their business.

- SAP’s relationship with member agents is consultative, helping them achieve their goals.

Joe Craven, CEO of Fortified, another five-star awardee, added that independent agencies have a crucial role to play within the insurance space.

“Independent agencies are the foundation of our industry,” he explained. “They’re small businesses that work hard to provide the best coverage possible for their clients, but unfortunately being a ‘small’ business can make it harder to develop partnerships with carriers.”

Tennessee-headquartered Fortified is a group of independent insurance agencies that share similar core values.

“Members can lean on each other’s expertise and that goes a long way for members that are coming in,” Craven said. “We also do a really good job of managing the relationships with the carriers on their behalf.”

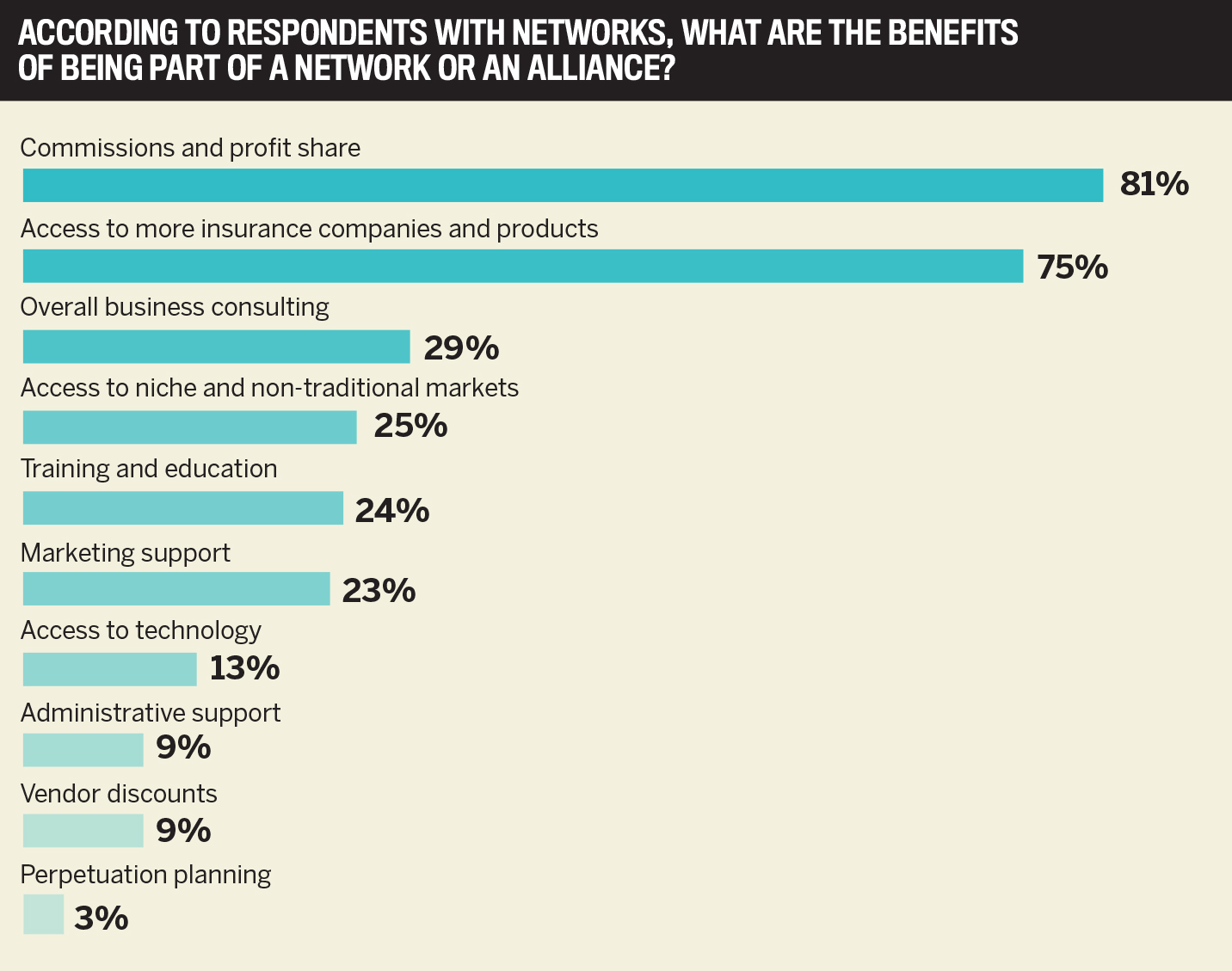

Insurance Business reached out to insurance agents across the US to find out what they consider the biggest benefits of joining an insurance networking group. The bar graph below reveals the top 10 advantages of insurance network memberships based on the poll results.

Bill Kaatman, director of enterprise development at Valley Insurance Agency Alliance (VIAA), emphasized the importance of commissions and profit sharing in insurance networking.

“There are some enhanced commissions we provide,” he noted. “We negotiate at a local or a national level. We run our numbers, and we are very keen to the fact that we have a majority of our members who we pay more than they pay us, and we’re extremely proud of that.”

Five-star awardee VIAA was established in 2006 to help small insurance agencies address common industry challenges. Among the benefits the insurance network offers its members are:

- More cost-effective carrier relationship than a standalone agency

- Special collaborative spirit resembling a “brotherhood”

- Access to markets, business consulting, and profit sharing

“I think carriers prefer working with us because they can more cost effectively manage growth and profitability,” added Robert Qaoud, VIAA’s director of operations.

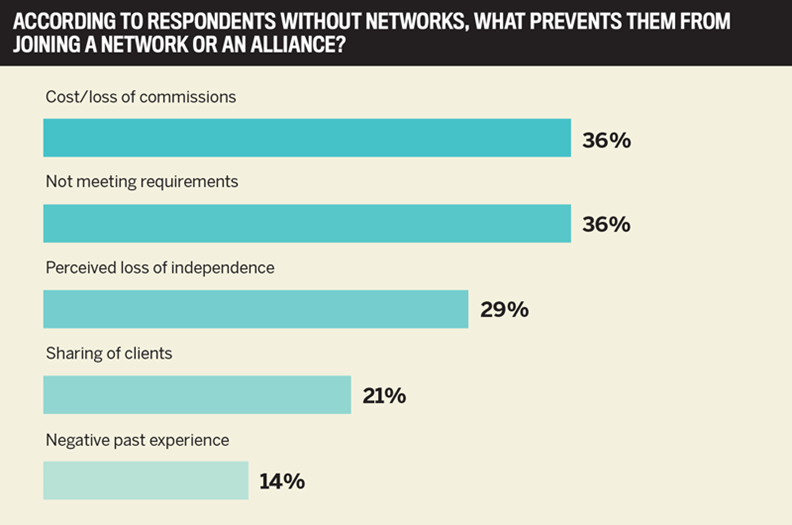

Insurance Business’ survey also reveals the top factors preventing non-member insurance agencies from joining an insurance network or alliance:

Craven, however, disagreed, describing the survey results as an “outdated perception.”

“What they’re saying is the furthest from the truth,” he explained. “We don’t have any of the client information. We don’t take their commissions.”

Qaoud supported Craven’s assessment and noted how transformative a network could be for independent agents.

“Some of the other networks out there can really ruin it for the good ones,” he said. “Plus, there’s a lot of myths out there. If we can get them to listen, we can show them the value and the reality of what we have to provide versus the perceived loss of independence.

“We’re nothing without our members. We’re fortunate to work with really good people. We have core values, and unless a prospect exudes those values, we don’t work with them. We really want to work with good family people and help them enhance their legacy.”

If you want to learn more about the top insurance networks and alliances in the US, you can check out our Best in Insurance America Special Reports page. Here, you can also find information about the other award-winning industry professionals in different fields.

Do you have other insurance networking tips that you want to share? Do you think joining insurance networks and alliances is worth it? Feel free to share your thoughts below.

Keep up with the latest news and events

Join our mailing list, it’s free!

[ad_2]

Source link