[ad_1]

How do you become an insurance broker? You must have the right attitude and skills, an expert says. Read on and find out what it takes to be successful

Becoming an insurance broker can be an attractive option if you want to work in a thriving industry that rewards hard work and dedication. Choosing this career, however, comes with its share of challenges.

In this article, Insurance Business will give you an overview of the profession. We will explain what an insurance broker does and the steps on how to become one. We also talked to an industry expert who will discuss what makes this career fulfilling and what it takes to succeed.

If you’re wondering if a career as an insurance broker is a great fit, you’ve come to the right place. Read on and find out how to become an insurance broker.

As an insurance broker, you often act as an intermediary between the buyers and insurance companies. You represent families and businesses, helping them find the policies that match their unique needs.

In some states, insurance brokers carry a fiduciary duty. This means that you’re legally required to act only in the best interests of your clients. You’re also expected to guide them throughout the whole insurance-buying process.

You can choose to work independently or as part of an insurance brokerage firm. Because you’re not bound to a particular insurer, you can offer clients more options than agents who represent insurance companies. You also have more freedom to place policies with different insurers depending on market conditions. This lets you access the best possible coverage for your clients.

If you want to become an insurance broker, there are generally three types of roles you can choose from:

1. As a retail insurance broker

These client-facing professionals work closely with the insurance buyers. They assist families and businesses in finding the best possible coverage. Retail insurance brokers often handle less complex policies that cover common risks.

2. As a wholesale insurance broker

Wholesale insurance brokers offer more specialized policies. These professionals rarely have direct contact with insurance buyers. Instead, retail brokers rely on them for policies that cover more complex risks.

3. As a surplus lines insurance broker

These brokers hold special licenses that allow them to access policies for highly complex risks that regular insurers aren’t willing to cover. They can choose to be either a retail or wholesale broker and provide products from surplus lines specialists, also called non-admitted insurers.

Besides insurance policies, you can offer risk management services. These may include advising clients on how they can manage risks that aren’t covered by their policies.

Insurance brokers, however, still owe insurance companies certain responsibilities. These include ensuring that the information you provide insurance underwriters during application is truthful and factual. You must also make sure that your clients can afford the monthly premiums.

Some insurers give brokers the authority to quote, bind coverages, and handle claims on their behalf.

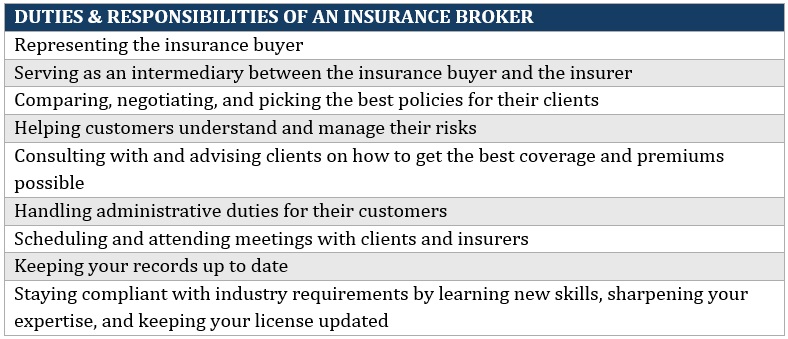

Here’s a summary of the duties and responsibilities of an insurance broker.

Although often confused with each other because of their jobs, insurance brokers and agents have distinct roles. Unlike agents who are obligated to sell the policies of their partner insurers, brokers can access products from a wider range of providers.

There are two types of insurance agents:

- captive insurance agents who work exclusively with an insurance provider

- independent insurance agents who represent several insurance companies

Just like insurance brokers, agents act as a go-between for the consumers and insurance companies. Because agents represent the insurers, the products they provide are limited to what their partner carriers offer.

Typically, insurance agents also have contracts with insurance providers detailing what policies they can sell and how much they can expect from selling these policies.

One of the biggest reasons that makes a career as an insurance broker worthwhile is having the opportunity to change people’s lives for the better. This sense of fulfillment is just among the many reasons why being an insurance broker is rewarding.

“There is absolutely no better career than being a good insurance broker,” says Adam Frugoli, vice-president and broker at Utah-headquartered insurance brokerage Leavitt Group. “I’ve built relationships with my clients and carrier partners that will last a lifetime. I’ve been invited to their families’ weddings and celebrations. We’ve cried together at funerals just like a member of their family.”

Here are some of the biggest benefits of pursuing a career as an insurance broker.

Challenging and rewarding work

Because insurance is a continuously evolving sector, you will often face challenges that will require you to come up with innovative and creative solutions. This can lead to a gratifying feeling at the end of the day.

Job security

People will always need someone to turn to if they need financial protection. As an insurance broker, you will be on top of their minds. As long as insurance is in high demand, your services will also be sought-after.

Strong earning potential

A career as an insurance broker offers great compensation with a high potential for growth – if you’re willing to put in the effort. Read this guide to find out how much insurance brokers make.

Flexible work arrangements

The nature of the job gives you the freedom to set your own work schedule. There are also plenty of opportunities to work from home.

Social relevance

You will have plenty of chances to help people overcome hardships. These include helping families recover from losing a loved one or a health-related issue. You can also assist businesses in recouping lost assets and investments.

If you want to pursue a career as an insurance broker, there are several steps you need to take:

1. Meet basic eligibility criteria

Aspiring insurance brokers must be at least 18 years old. This is the minimum age to apply for a license in most states. You must also be able to successfully complete a background check. This means you must be free of any fraud or felony charges and not owe any federal or state income taxes.

2. Pass the state licensure exam

Before you can legally sell policies, you must get a license from your state’s insurance regulation department. This involves choosing a line to specialize in and completing a pre-licensing course. You can take insurance classes online or in person.

The courses are designed to prepare you for the state licensure exam. You’re only required to take the test for the line that you plan on specializing in. Each test consists of 50 to 200 items and must be completed in two to three hours.

The passing scores vary in each state. Typically, you must get at least 70% of your answers correctly to pass.

3. Apply for your insurance license

Your exam results are valid for two years, and you need to get your license during this period. Fail to do so and you forfeit your eligibility.

You can apply for an insurance producer license on your state insurance regulation department’s website. This comes with a corresponding fee.

The department reviews all license applications. There’s no specific timeframe for this as each application is treated differently. If something comes up from your background check, the department may contact you for clarification.

You can find out if your license application has been approved or rejected also through the department’s website. If approved, you can ask for a PDF copy of your license. Most states don’t mail printed licenses for security reasons. So, you may need to download and print the license yourself.

4. Get a broker bond

Among the important steps on how to become an insurance broker is obtaining a broker bond. You need to secure one before you can sell insurance in most states, according to the industry group Independent Insurance Agents & Brokers of America (IIABA). Broker bonds are a type of surety bond designed to hold brokers accountable for their actions. It also helps protect the public from potential fraud.

6. Pursue continuing education

Most states require at least 24 hours of continuing education (CE) credits during a two-year term to maintain your insurance broker license. CE courses are also designed to keep your skills updated.

You will need to take classes related to the line you’re specializing in and a few hours of law and ethics training. P&C brokers may also need to take a few flood insurance credits.

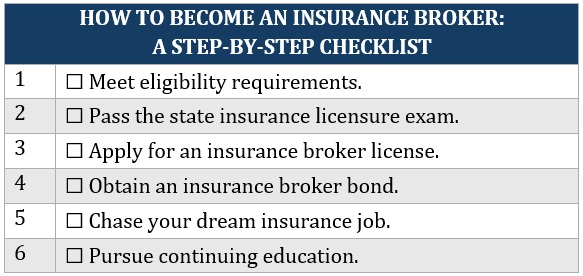

Here’s a step-by-step checklist on how to become an insurance broker:

While being an insurance broker can be a rewarding career for those who put in the effort, it comes with its own share of challenges. The biggest of which is being constantly accessible.

“We have no office hours. Clients are busy. That means I need to be available when they need me,” Frugoli explains. “Your clients rely on you to make sure their most valuable assets, reputation, and income are protected properly in case the unforeseen happens.

“We are the first people that get called when something happens no matter the time of day or night. [Clients] are looking to you to tell them that everything is going to be okay.”

Frugoli adds that he travels with a satellite phone because he always needs to be reachable.

“There is an incredible amount of pressure in this career. Your spouse, partner, and family need to be completely supportive of this career.”

To succeed as an insurance broker, you need a combination of hard and soft skills that let you build meaningful relationships with clients. This, in turn, enables you to offer them the best coverage possible.

“You have to be extremely driven, responsive, disciplined and patient,” Frugoli says. “It takes years to build trust and it can be wiped away with one bad experience – you’re done, no second chance.”

Frugoli adds that the best way to do this is to focus on every aspect of the relationship. “I’m involved with everything because the buck stops with me,” he explains. “When issues or mistakes happen, they don’t see an insurance company, an account manager, or claims adjuster. They just see me.

“I have a rule for my team of account managers – it is that I deliver all bad news, no exceptions.”

When asked about what advice he would give to those who want to pursue this career path, Frugoli said budding insurance brokers should “aspire to be great.”

“Never compromise your integrity or abuse the trust that has been placed in you by the client and the insurer. Never, ever forget, nothing happens unless someone sells something,” Frugoli says.

“If this job was easy, we wouldn’t be rewarded like we do. This means you need to micromanage every minute spent and be maniacal about prospecting. This business can trick new producers into thinking they’re busy. Yes, they’ve been busy all day. Unfortunately, they failed because their time wasn’t spent on revenue-producing activities.”

Having a role model is also important if you want to succeed in the profession. If you’re new in the industry and looking for someone to look up to, you need not go far. Our Best in Insurance Special Reports page is the place to go if you’re searching for respected industry leaders.

Recently, we unveiled our five-star awardees for the Top Insurance Brokers and Agents. Find out how these professionals rose to the ranks to thrive and flourish in their careers by checking out the special report.

Did you find this guide on how to become an insurance broker helpful? What skills and attributes do you think aspiring brokers need to succeed? Share your comments below.

Keep up with the latest news and events

Join our mailing list, it’s free!

[ad_2]

Source link