[ad_1]

Getting a Florida insurance agency license is crucial if you want to start an insurance sales business in the state. Here’s a step-by-step guide on getting one

All businesses involved in selling insurance in Florida are required to have the proper licenses to operate legally. This is one of the first and most important steps you must take if you want to start your own insurance business in the state. Getting a Florida insurance agency license, however, is no easy matter.

To help you sort things out, Insurance Business sifted through all information available on the Florida Office of Insurance Regulation’s (FLOIR) website. We will explain the different licensing requirements, the application process, and what it takes to maintain your agency license.

If you’re planning on starting your own insurance sales business in the Sunshine State, this guide can help. Read on and find out everything you need to know about getting your Florida insurance agency license.

If you’re opening a business that employs an insurance agent, Florida statutes require you to register your business as an insurance agency and get the proper license.

Before you can apply for a license, you must designate a licensed agent in charge of your business. Aptly called the agent-in-charge, this industry professional is responsible for overseeing all insurance agents and matters involving insurance sales. Each branch is required to have an agent-in-charge, although they don’t have to be separate individuals.

Agents-in-charge can manage different locations if they are present every time an insurance sales transaction is conducted. They are also accountable for any misconduct or violation of the Florida Insurance Code committed by your agency or agents under their supervision.

All businesses operating as an insurance agency in the state should get a 21-05 insurance agency license. This applies to all resident and non-resident insurance agencies.

Here’s a step-by-step guide on how to get a Florida insurance agency license:

Step 1: Appoint an agent-in-charge.

As mentioned, Florida statutes require all insurance agencies to appoint an agent-in-charge to supervise insurance sales transactions. An agent-in-charge must be licensed in the lines of authority your business specializes in. If your agency sells policies in multiple lines, your appointed agent must hold licenses in all those lines.

Here are the different licenses your agent-in-charge may need to obtain:

Florida insurance agency license – which types of licenses does an agent-in-charge need?

|

Line of authority

|

Type of insurance license

|

|

|

|

Resident

|

Non-resident

|

|

General lines

|

|

|

|

Life

|

2-16

|

8-16

|

|

Health and life, including variable annuity

|

|

|

|

Health

|

|

|

|

Health and life

|

2-18

|

8-18

|

|

Life, including variable annuity

|

|

|

|

Personal lines

|

|

|

If the employee holds only a limited-lines insurance license or any other license not included in the table, they are not qualified to become the agent-in-charge of your business.

Step 2: Apply for your insurance agency license.

You can apply for your Florida insurance agency license online on the MyProfile portal of the Florida Department of Financial Services (FLDFS) website.

If you don’t have one yet, you will need to create an account to log in and submit your application. You can also use your account to update your business information, including changes in the registered business name, agent-in-charge, and officers involved in your insurance operations.

A note on registered names: FLOIR has guidelines on what words you can use for your business. Generally, your name should indicate that your business sells insurance or is an insurance agency.

You’re NOT allowed to use any of the following for your business name:

- the words Medicare or Medicaid

any word that implies that the agency is:

an insurance company

- a motor club

- a hospital service plan

- a Federal or state agency

- a charitable institution

- an entity that provides advice or counsel rather than sell insurance

- an entity that engages in insurance activities not permitted under licenses held or applied for

- names that are too similar to those of already registered agencies or insurers

- any word that may mislead the public

If your chosen name doesn’t meet these guidelines, the department may ask you to submit a new one.

3. Submit fingerprints.

You’re required to submit fingerprints of all officers and members of your insurance agency who participate in the management and control of the business. These include:

- owner

- partner/s

- director/s

- president

- senior vice-president

- secretary

- treasurer

- limited liability company (LLC) members

Because they already had their fingerprints submitted prior to obtaining their licenses, licensed insurance agents don’t need to be fingerprinted.

Fingerprinting fees cost $50.75 and must be paid directly to the vendor. FLDFS provides additional instructions on how you can properly submit fingerprints for your insurance agency on its website.

Step 4: Get your license.

You can use your MyProfile account to check the status of your license application. If there are any requirements that you failed to meet, you can find them under pending license type.

Once approved, you can download a copy of your Florida insurance agency license for printing. Your agency license contains information that consumers need to verify your license status. That’s why you’re required to display your license where it’s clearly visible to customers visiting your office.

Unlike insurance agent licenses, which must be renewed every two years, agency licenses are valid for as long as your business has a designated agent-in-charge. Without one, your insurance agency license will expire after 90 days.

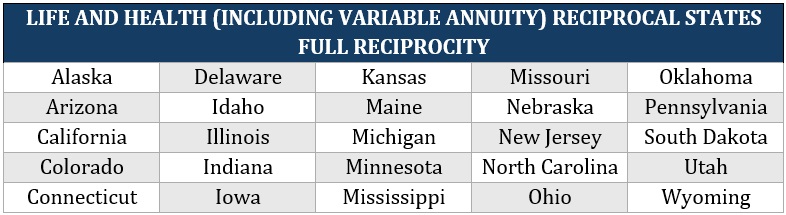

Florida has reciprocity agreements with other states and countries, allowing agents to take these jurisdictions’ licensure examinations without having to complete pre-licensing coursework. These agents, however, still need to pass the local licensure test for a license to sell insurance there.

Here’s a list of states and countries where Florida has reciprocal agreements with:

Life and health, including variable annuity, license reciprocity

Insurance agents who were licensed within the last four years are exempt from taking pre-licensing education in these states. Still, they must pass the state licensure exam to get their non-resident agent license.

The following states have conditional reciprocity agreements with Florida. This means that insurance agents must meet additional requirements to secure a non-resident license. They don’t have to take the pre-licensing courses but need to pass the state licensure test.

- Alabama

- Maryland

- Massachusetts

- Montana

- Nevada

- New Hampshire

- North Dakota

- Oregon

- Rhode Island

- Texas

- Vermont

- Virginia

- Washington

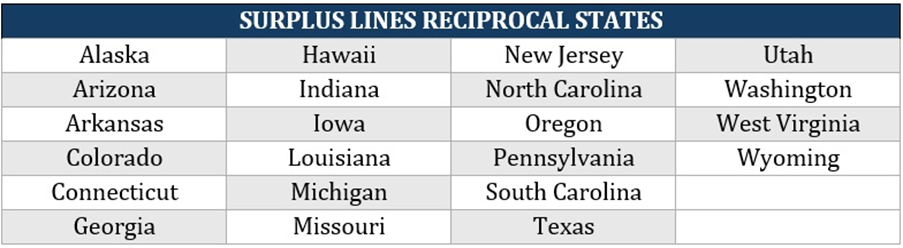

Surplus lines license reciprocity

Florida insurance agents who passed the surplus lines examination are exempted from taking the test in these states.

Puerto Rico license reciprocity

Florida has a reciprocal agreement with Puerto Rico for the following lines of insurance:

- 21-05 – Insurance agency

- 8-14 – Life and variable annuity

- 8-15 – Life, health/disability, and variable annuity

- 8-40 – Health

- 9-20 – Property and casualty

- 91-20 – Surplus lines

Canada license reciprocity

Florida has reciprocal agreements with all Canadian provinces and territories, except Québec, for the following insurance lines.

- 8-14 – Life and variable annuity

- 8-15 – Life, health/disability, and variable annuity

- 8-40 – Health

Florida statutes require any business or individual involved in insurance sales to get the proper licenses. Selling insurance without the necessary licenses can result in a felony charge. If your insurance agency or someone you employ is caught doing so, you can face substantial financial and legal penalties. These include fines, blocked commissions, and even suspension or revocation of insurance and business licenses.

The FLOIR may also issue cease-and-desist orders to prevent your insurance agency from doing business. You may be required to pay any unsettled insurance claims if this happens.

Getting the right licenses is just the first step in running your own insurance agency. The real challenge is keeping your business profitable.

To keep clients coming and cash flowing, you must have a clear vision of how you can maintain profitability. Here are some practical tips on how to do so.

1. Be clear of your goals.

Setting goals plays a crucial role in giving your insurance agency a clear vision of where it wants to go, how to reach these targets, and what new products and services it can offer. Being goal-oriented also helps keep you and your employees motivated. If set correctly, your business goals can help you measure how successful your insurance agency is.

2. Identify your niche.

As clients’ needs evolve constantly, so does the demand for different insurance products. This presents an opportunity for your insurance agency to find a niche that will help it grow. While the road to discovering your business’ niche market takes time and effort, it can also reap dividends in the long run.

3. Find and nurture new leads.

Success in insurance sales means having to constantly drive leads. There are several strategies that can help your agents tap new leads. These include targeted marketing and multi-channel lead generation. If you want to learn more lead-generation strategies, this guide to finding new insurance leads may help.

4. Boost your network.

In a relationship-oriented industry such as insurance, building strong connections with clients is vital to the success of every business. A good insurance networking system helps your insurance agency establish meaningful connections with potential customers and win them over. You can find several practical strategies on how to boost your insurance network in this guide.

5. Take advantage of the latest technology.

Many insurance experts believe that the only way for the industry to move forward is to embrace technological innovation. This is reflected in the increased adoption of AI, blockchain, cloud computing, IoT, and telematics to reduce costs, mitigate risks, and keep clients engaged.

6. Take care of your employees.

Another effective way to make your insurance agency succeed is to take care of your most important asset – your employees. A great insurance employer offers the best work environment that paves the way for staff to thrive and grow. A positive workplace culture is also among the top factors that keep employees engaged. An engaged workforce is key to reducing turnover, boosting productivity, and maintaining profitability.

Is starting your own insurance agency in Florida a good idea?

The continued growth of the insurance sector presents a massive opportunity for aspiring insurance entrepreneurs who want to dip their toes in the industry.

Florida’s insurance market, however, operates differently than those in most states. That’s why starting your own insurance agency requires careful planning, hard work, and dedication. If you want to start your own insurance business but are not quite sure where to begin, this step-by-step guide on how to start an insurance company can assist you.

Do you think getting a Florida insurance agency license is worth the effort? Is starting your own insurance agency in Florida a good business venture? Let us know in the comments section below.

Keep up with the latest news and events

Join our mailing list, it’s free!

[ad_2]

Source link