[ad_1]

Co-founder reiterates commitment to “excellence and resilience”

Following excellent ratings for both its P&C and reinsurance arms, SWBC has underscored its financial strength within the sector as it marked a milestone.

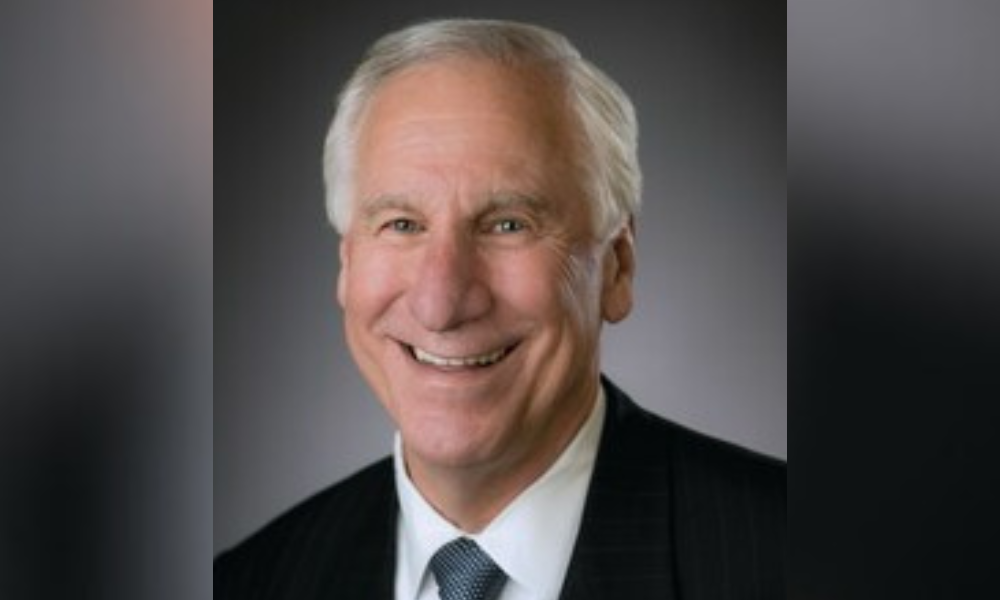

Charlie Amato (pictured above), co-founder and chairman of SWBC, reflected on the company’s journey and these new achievements, a culmination of a nearly-50-year journey.

“Although the global landscape has presented challenges, we remain dedicated to excellence and resilience,” Amato said. “This steadfast devotion has earned the trust and confidence of our clients, making us stronger than ever. It is proof of our dedication to providing our clients the best possible service and financial security.”

Gary Dudley, SWBC’s co-founder and president, also emphasized the importance of client satisfaction and trust in the company’s success strategy.

“In a world where options abound, being the best fit for our clients isn’t just an advantage – it’s imperative. By prioritizing their satisfaction and earning their trust, we solidify our position as the go-to partner for their needs, now and in the future,” Dudley said.

Excellent initial ratings for both businesses

The firm’s SWBC Property and Casualty Insurance Company and SWBC RE segments have both been awarded an initial A- (Excellent) rating by AM Best, which the credit agency attributes on maintaining financial stability.

The awarded ratings also mirror SWBC’s robust balance sheet, adequate risk management strategies, and other key performance indicators.

“We are thrilled that two more of our insurance companies, SWBC Property and Casualty Insurance Company and SWBC RE, Ltd., have received an A- (Excellent) rating, complementing the current AM Best A- rating held by SWBC Life. Our financial strength rating emphasizes our allegiance and trustworthiness as a reliable partner for our clients,” SWBC Property & Casualty Insurance Company president and CEO Joan Cleveland said.

“At the heart of SWBC’s success lies a deep-rooted tradition of reliability and excellence,” Jim Pangburn, CEO of SWBC RE, added. “This tradition is upheld by our leadership, who are dedicated to preserving our legacy of financial strength. As we move forward, our focus remains on embracing innovation, of which we can all be proud.”

SWBC Property and Casualty specializes in developing bespoke payment protection programs for financial institutions and auto dealerships. SWBC RE, on the other hand, operates as a reinsurer of debt cancellation programs and is now set to broaden its reinsurance offerings.

What are your thoughts on this story? Please feel free to share your comments below.

Related Stories

Keep up with the latest news and events

Join our mailing list, it’s free!

[ad_2]

Source link