[ad_1]

The largest property and casualty insurance companies in the world wrote a combined $1.45 trillion in premiums in the past year. Find out which insurers rank in the top 10

The global property and casualty (P&C) sector continues to face unprecedented challenges, pushing up claims costs and making investment returns less predictable. Many P&C insurers weathered the storm by making big changes in how they conduct business.

These include the firms on this list. In this article, Insurance Business ranks the world’s largest property and casualty insurance companies based on written premiums in the past year. We will also provide a region-by-region breakdown of the top P&C insurers. The figures in this guide are based on the data market intelligence firm S&P Global gathered.

Read on and learn more about the industry’s biggest players in this article.

The 50 largest P&C insurers in the world have written more than $1.45 trillion in premiums in the past year, according to S&P Global’s data.

US-based insurance companies dominated the list, accounting for 40% of all written premiums. China is the second-most represented country, with insurers there contributing over 12% to the global figure.

In terms of region, North America is home to the largest number of insurers at 23, responsible for 46% of the overall premiums written. Europe comes next contributing 33.5% to the total. Asia follows accounting for 20.7%.

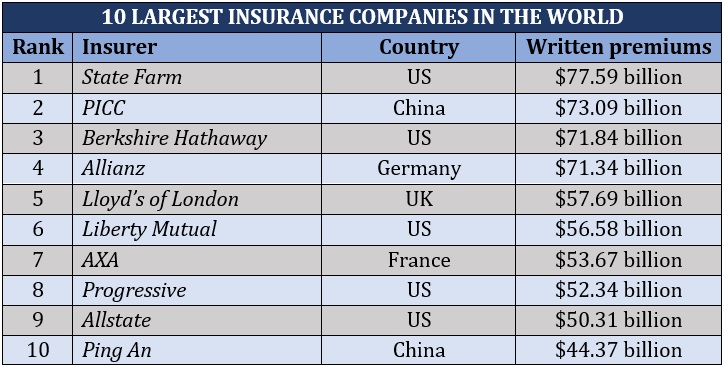

Here are the top 10 largest property and casualty insurance companies in the world based on the report.

1. State Farm

Country of domicile: US

Direct written premiums: $77.59 billion

Market share: 5.34%

State Farm is the industry’s biggest player, both in the US and overseas. The Bloomington, Illinois-based P&C insurance giant wrote almost $78 billion worth of premiums in the past year. The company offers a range of car, home, and small business policies. It also has a robust portfolio of life, health, and disability coverage.

The insurer is well known in the industry for providing competitive auto insurance rates. However, except for personal auto coverage, State Farm has ceased writing new policies in California. The company points to inflation, difficult reinsurance market, and increasing catastrophe exposure as the main reasons for the pullback.

State Farm policies are available exclusively to US clients. The insurer boasts a network of 19,000 agents nationwide.

2. PICC

Country of domicile: China

Gross written premiums: $73.09 billion

Market share: 5.03%

Beijing-headquartered People’s Insurance Company (Group) of China, more popularly known as PICC, operates as an insurance and investment holding firm. The industry giant runs its P&C insurance business through its subsidiary, the PICC Property and Casualty Company.

PICC’s P&C arm offers a range of general policies, including motor vehicle, homeowners, commercial, liability, hull and cargo, aviation, and credit and surety insurance. Apart from being the largest, the unit is also the oldest non-life insurance provider in mainland China.

PICC holds license from the Chinese Ministry of Finance to underwrite short-term export credit insurance. So far, it is the only commercial insurer in the country’s export credit market. PICC Property and Casualty Company has about 4,500 branches across China.

3. Berkshire Hathaway

Country of domicile: US

Gross written premiums: $71.84 billion

Market share: 4.95%

Berkshire Hathaway owns several insurance and reinsurance subsidiaries specializing in property and casualty insurance. One of its most popular P&C brands is car insurance specialist GEICO. The Omaha, Nevada-headquartered conglomerate is also the firm behind prominent industry players:

- Alleghany Corporation

- Berkshire Hathaway Direct

- Berkshire Hathaway GUARD

- Berkshire Hathaway Homestate Companies (BHHC)

- Berkshire Hathaway Specialty Insurance

- Central States Indemnity Co. of Omaha

- biBERK

- National Indemnity Company

- United States Liability Insurance

Insurance is considered among Berkshire Hathaway’s “four giants.” The business accounts for about a quarter of the conglomerate’s total revenue.

Berkshire Hathaway is owned by Warren Buffet, one of the insurance industry’s richest tycoons. The man who is known as the “Oracle of Omaha” is a constant fixture on Forbes’ billionaires list with a net worth of around $120 billion.

4. Allianz

Country of domicile: Germany

Gross written premiums: $71.34 billion

Market share: 4.91%

Munich-headquartered Allianz SE offers a range of property and casualty insurance policies through its subsidiaries in more than 70 countries and territories. Its global workforce of 155,000 personnel serves over 126 million clients worldwide.

Some of the P&C insurance giant’s most notable brands are:

- Allianz Global Corporate & Specialty (AGCS): A multinational insurer providing business insurance and coverage for large corporate and specialty risks.

- Euler Hermes: The group’s credit insurance arm offering bonding, guarantees, and collection services for managing business-to-business (B2B) trade receivables.

Apart from property and casualty insurance, Allianz’s portfolio includes life and health insurance, and asset management services.

5. Lloyd’s of London

Country of domicile: UK

Gross written premiums: $57.69 billion

Market share: 3.97%

Lloyd’s of London is the world’s leading insurance and reinsurance marketplace, with a presence in more than 200 countries and territories. Its member syndicates provide coverage to practically every type of risk. The marketplace caters to all kinds of clients from national governments and multinational conglomerates to start-ups and small enterprises.

The premiums above are combined totals from 80 member syndicates. Some of the premiums may be included in the overall figures of insurance companies in the list that own Lloyd’s syndicates.

6. Liberty Mutual

Country of domicile: US

Gross written premiums: $56.58 billion

Market share: 3.89%

One of the largest property and casualty insurance companies in the world, Liberty Mutual ranks third among all US insurers in the list. The mutual insurer boasts a 45,000-strong workforce in about 900 locations globally.

Liberty Mutual specializes in providing cover for different P&C risks. Its portfolio includes:

The mutual insurer conducts business through two units:

- Global Retail Markets (GRM): The unit combines the insurer’s expertise in growth markets outside the US with strong and scalable US capabilities. This enables the company to take advantage of opportunities to grow its business internationally.

- Global Risk Solutions (GRS): This consists of the firm’s property, casualty, specialty, and reinsurance products and services. The policies are distributed through Liberty Mutual’s global network of insurance agents and brokers.

Liberty Mutual is also known for providing clients with flexible rates.

7. AXA

Country of domicile: France

Gross written premiums: $53.67 billion

Market share: 3.69%

Paris-based AXA S.A. operates as a multinational insurance and asset management services provider. It boasts a global network of 145,000 employees and distributors, making it among the largest property and casualty insurance companies worldwide.

AXA serves around 93 million clients in more than 50 countries and territories. Apart from P&C insurance, the company operates health insurance, life and savings, and asset management divisions. North America, Western Europe, the Asia-Pacific region, and the Middle East are its key markets.

8. Progressive

Country of domicile: US

Gross written premiums: $52.34 billion

Progressive is the second largest car insurer in the US, trailing only State Farm. But the Ohio-based P&C insurance company ranks on top of the country’s motorcycle and specialty RV segment. The firm’s property and casualty portfolio includes:

- auto insurance

- motor vehicle insurance

- homeowners’ insurance

- condo insurance

- renters’ insurance

- commercial insurance

- boat insurance

- pet insurance

Progressive’s policies can be accessed directly or through its network of 38,000 independent agents. The insurer’s products and services are mostly available in the US and Canada. The company writes more than 13 million auto insurance policies every year.

9. Allstate

Country of domicile: US

Gross written premiums: $50.31 billion

Market share: 3.46%

Allstate is one of the largest publicly traded P&C insurers in the US, with around 16 million policyholders and 175 million policies in-force. The company offers a range of coverage under the property, vehicle, life, and commercial insurance segments. It is also the name behind popular insurance brands Answer Financial, Encompass, and Esurance.

Allstate products and services can be accessed primarily through its captive agencies. The firm has about 12,300 agents and financial representatives across the US and Canada.

10. Ping An

Country of domicile: China

Gross written premiums: $44.37 billion

Market share: 3.05%

Shenzhen, Guangdong-headquartered Ping An is among the largest property and casualty insurance companies in the world. It caters to more than 220 million customers and almost 611 million online users.

The group offers P&C policies primarily through its subsidiary, Ping An Property & Casualty Insurance Co. of China Ltd. Its products include:

- accident and health insurance

- auto insurance

- corporate property and casualty insurance

- cargo insurance

- engineering insurance

- guarantee insurance

- home contents insurance

- international reinsurance

- liability insurance

- trade credit insurance

The company also has a robust health and life insurance portfolio delivered through its brands Ping An Life, Ping An Annuity, and Ping An Health. The firm employs more than 362,000 staff worldwide.

Here’s a summary of the top 10 largest property and casualty insurance companies in the world.

Largest property and casualty insurance companies – region-by-region breakdown

S&P Global’s data can be broken down into three major regions:

- North America

- Europe

- Asia-Pacific

Here are the 10 top P&C insurers in each region based on the figures the market intelligence firm gathered.

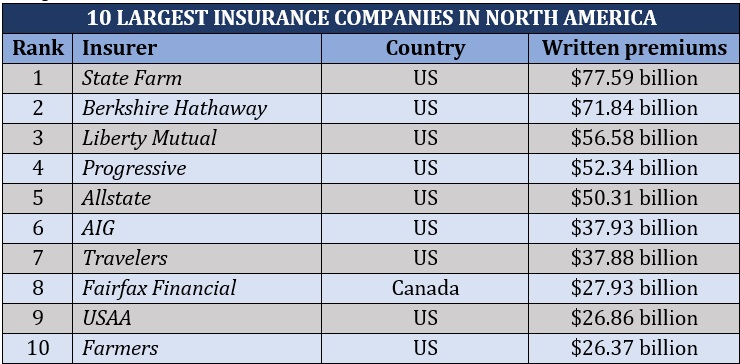

The largest P&C insurers from the US and Canada accounted for $636.95 billion, or almost 44% of the premiums written globally. Of these, $474.59 billion, or about a third, were from the top 10 North American property and casualty insurance companies.

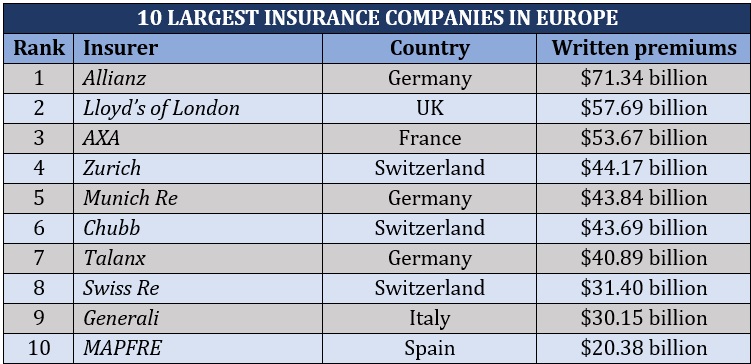

The biggest industry players from Europe have written a combined $495 billion in premiums. This is around 34% of the global figure. The top 10 companies in the region contributed almost $446 billion to the total.

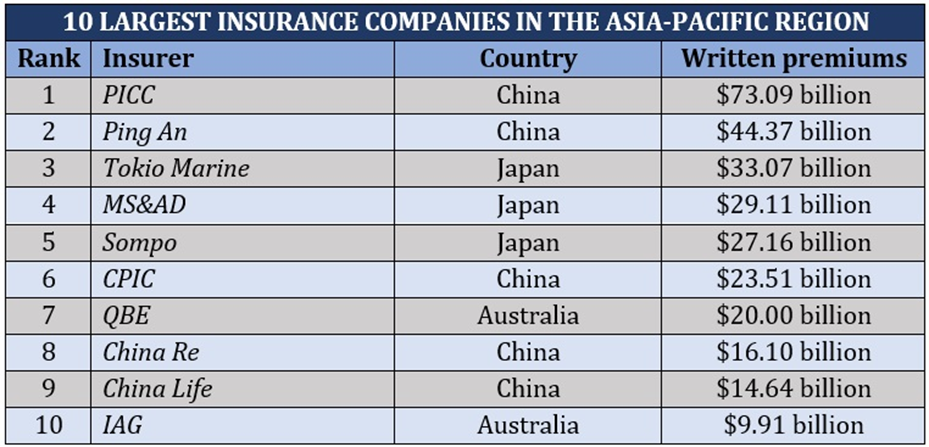

There are 11 property and casualty insurers in the top 50 that are based in the Asia-Pacific region. These companies accounted for nearly $300 billion in written premiums or about a fifth of the overall figure.

The P&C insurance segment consists of two lines:

1. Personal lines insurance

This type of insurance protects individuals and their assets when unexpected disasters strike. The segment includes:

- business interruption insurance

- commercial auto insurance

- commercial property insurance

- cyber insurance

- directors’ and officers’ liability insurance

- general liability insurance

- product liability insurance

- professional liability insurance

- workers’ compensation insurance

If you want to find out which property and casualty insurance companies in the world offer the best protection, Our Best in Insurance Special Reports page is the place to go. Recently, we unveiled our five-star awardees for the Global Best in Insurance.

Here, we recognized insurance professionals and companies across North America, the UK, and the Asia-Pacific region who have excelled and raised the bar to offer top-notch services.

What do you think of the largest property and casualty insurance companies on our list? Do you have experience working with them? We’d love to see your story below.

Keep up with the latest news and events

Join our mailing list, it’s free!

[ad_2]

Source link